Ukraine president Volodymyr Zelenskyy is expected to sign a critical minerals deal at the White House on Friday, after weeks of pressure from President Donald Trump seeking repayment for U.S. aid in Ukraine’s war with Russia.

Canada will be watching.

Trump has threatened to annex Canada with an eye on its rich supply of critical minerals crucial to diverting U.S. economic and defence supply chains away from foreign rivals like China.

Here’s an overview of Canada’s critical minerals and why they are important to the United States and other partners.

WHAT ARE CRITICAL MINERALS?

Critical minerals are found in everything from mobile phones and solar panels to EV batteries, medical devices and military equipment. They have few, if any, substitutes.

Canada lists 34 minerals and metals critical for economic and national security, its energy transition and export markets. The list includes nickel and copper — although there’s a debate over whether they are critical — as well as lithium, cobalt and rare earths.

Many of these are also on a list of minerals important to the United States.

As Trump threatens Canada with tariffs and “economic force” to make it the 51st state, some observers say Ottawa should use critical minerals as leverage in fending off U.S. ultimatums.

But which ones are the most critical, and why does the United States want them?

WHAT ARE CANADA’S KEY CRITICAL MINERALS?

At the heart of the issue is China’s monopoly over critical minerals essential for advanced technologies and defence, two areas where the U.S. is trying to boost domestic manufacturing and production.

Natural Resources Canada prioritizes six minerals — lithium, graphite, cobalt, nickel, copper and rare earth elements — for their potential to spur economic growth and role in key supply chains.

These minerals are used in rechargeable batteries, wind turbines and energy storage for renewable energy like wind and solar. Demand is expected to rise in the coming years as the world shifts toward clean energy.

The U.S. military also needs critical minerals.

An F-35 fighter jet has 920 lbs (417 kg) of rare earth elements and China dominates the market for these materials. The U.S. also needs materials to rebuild its munitions and equipment stockpiles strained by conflicts in the Middle-East and Ukraine.

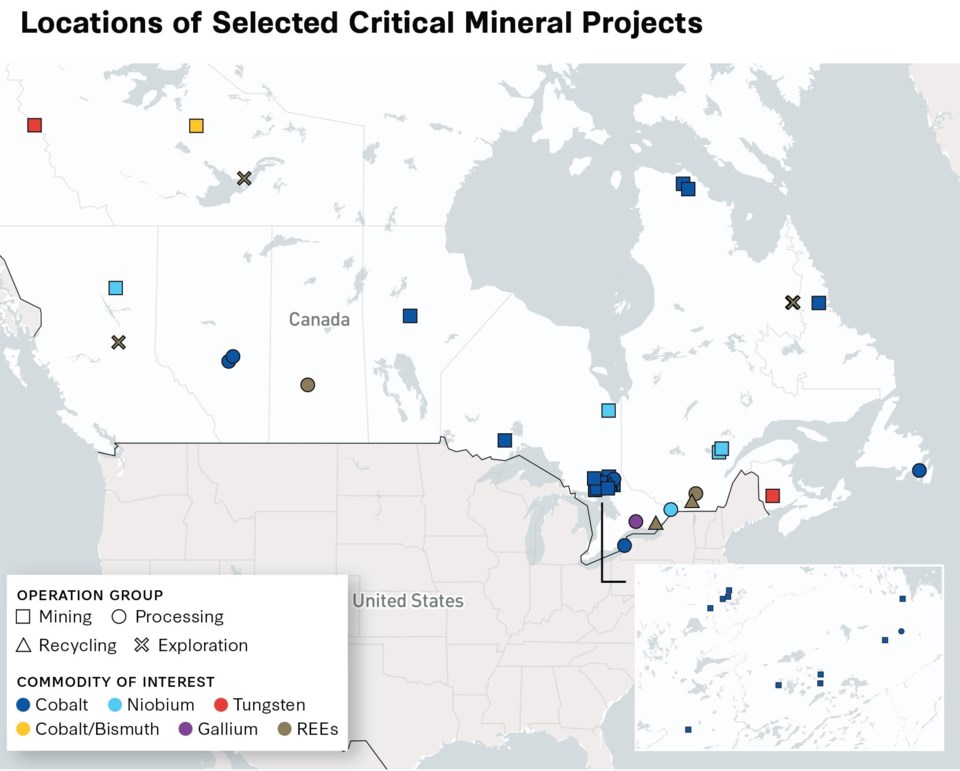

Canada is home to five critical minerals essential for U.S. defence: gallium, niobium, rare earth elements, cobalt and tungsten, said a report this month by CSIS, a U.S. think tank.

Since the U.S. gets most of its critical minerals from China or Chinese-owned firms operating in other countries, these supply chains are a major security vulnerability.

Trump is eyeing Ukraine, Greenland and Canada for alternative sources to break China’s monopoly. Meanwhile, Beijing is pushing back against U.S. tariffs on Chinese goods with export controls on five critical minerals, including tungsten.

Canada — with its specialized workforce, favourable business environment, stable government and vast critical mineral reserves — would be a key ally in helping the U.S. reduce its reliance on China, CSIS said.

“While fears of a trade war have rattled U.S.-Canada relations, cooperation between the two countries remains essential to safeguard North American prosperity in the face of rising threats,” the report said.

WHAT ARE CRITICAL MINERALS USED FOR?

Lithium

Lithium is a highly reactive metal used in rechargeable batteries for laptops, mobile phones and electric vehicles, as well as for storing renewable intermittent energy from solar power and wind.

Australia is the world’s largest lithium producer followed by Chile and China.

Canada has 3.6 per cent of the world’s lithium reserve, but only two mines in Manitoba and Quebec that account for 0.4 per cent of world production. New projects are underway in Alberta and Ontario.

Graphite

Graphite’s ability to conduct heat and electricity makes it ideal for lithium-ion batteries, fuel cells and nuclear reactors.

China has the biggest graphite reserves, accounting for 77 per cent of the world’s supply.

Canada’s only producing graphite mine is in Lac des Iles, Quebec. The U.S. is Canada's top graphite customer, buying 83 per cent of its natural graphite and 62 per cent of Canada's synthetic graphite in 2023.

Cobalt

Cobalt is a good conductor of heat and electricity, and keeps its strength at high temperatures. It’s found in jet engines and lithium-ion batteries, while cobalt’s magnetism is important for stealth defence technology.

Canada is the fourth largest producer of cobalt, but that’s a distant fourth: it only accounts for 2.2 per cent of global output. It has cobalt mines in Ontario, Quebec, Manitoba and Newfoundland and Labrador. A mine and milling operation is planned in the Northwest Territories.

Most of the world’s cobalt comes from either China or Chinese-owned companies in the Democratic Republic of the Congo (DRC). The U.S. Geological Survey lists cobalt at the third highest risk of supply chain disruption due to China’s monopoly on cobalt mining and processing.

Rare earth elements

Rare earths are a group of 17 metallic elements which have unique magnetic, luminescent and electrochemical properties used in advanced computing and defence.

Rare earths are usually found only in small amounts with other minerals. These deposits are often not economically viable and extracting them can be complex and expensive.

Nevertheless, they are crucial for electric vehicles and wind turbines, as well as for precision-guided munitions, missile technology and laser targeting systems in the U.S. military.

China, which dominates rare earth mining and processing, moved last year to take greater control of the supply chain. It required Western countries to submit detailed tracing of how rare earths exported from China were used — putting more pressure on the U.S. to find other options.

Canada has some of the world's largest reserves and resources of rare earths, but few processing options. Canada's first rare earths processing facility is being developed in Saskatchewan, while Quebec has two commercial-scale demonstration facilities.

Gallium

The U.S. needs Canadian gallium, a key component in cell phones, computers, advanced radar jamming systems, air and missile defences, radar, satellites and other communication equipment.

Toronto-based Neo Performance Materials is currently the only gallium producer in North America. Global mining giant Rio Tinto is assessing the potential for gallium mining at Saguenay-Lac-Saint-Jean, QC., and hopes to increase the world’s supply by 5 to 10 per cent.

Most of the world’s gallium comes from China and that monopoly makes it the critical mineral most at risk of supply chain disruption.

Niobium

Adding just a tiny amount of niobium to steel alloys can increase steel strength by over 30 per cent and significantly reduce its weight.

Niobium is essential for jet and rocket engines, superconductive wires and cables, batteries, and hypersonic weapons which travel at Mach 5 or higher and harder to detect.

Most of the world’s niobium comes from Brazil, where China owns stakes in most mining and processing companies. Canada is the world’s second largest niobium producer accounting for 10 per cent of global production.

Quebec’s Niobec mine owned by IAMGOLD Corp is Canada’s only producer, but there are potential deposits in British Columbia.

Tungsten

Combined with carbon, tungsten is stronger and harder than steel, and used for armour-piercing projectiles, rocket nozzles and turbine blades.

Tungsten is also the rarest mineral used by the defence industry. The U.S. depends entirely on imports for tungsten, making it a key supply chain vulnerability.

In Canada, the Mactung Project in Yukon and the Northwest Territories has been called the world’s largest high-grade tungsten deposit. Nevertheless, over 85 per cent of tungsten is produced and processed in China.

HOW IS CANADA DEVELOPING ITS CRITICAL MINERALS?

The size of Canada's critical mineral prize is clear, but Ottawa’s development plan needs a major rethink, one expert says.

Ottawa’s critical minerals strategy includes $1.5 billion to fund clean energy and transportation infrastructure projects for critical minerals. Some $212 million has been approved for 16 projects so far — from road building and new power grid connections to early-stage mine engineering.

"Some of the projects being funded are never going to make economic sense,” said London, executive director of the Canadian Critical Minerals & Metals Alliance, an industry advocacy body.

He argues Canada needs a handful of major projects that can be brought into production in a reasonable time, but should go beyond just digging stuff out of the ground.

"Critical minerals is not a mining story. It's a manufacturing story," he told Canada’s National Observer.

Canada has lost the “mining gig” to bigger critical mineral rivals in China and Australia, he said. Even if Canada spent billions of dollars to ramp up mining across the country, it still can’t add value by processing the materials from new mines.

Unlike commoditized metals like copper and nickel, the next generation of materials for renewables and clean technology — lithium, graphite, cobalt and rare earths — will be “very small volumes, very high refinement,” he said.

For this reason, Canada needs to invest in a network of processing facilities to supply the critical minerals needed for the global energy transition, he said.

"It is not the raw critical minerals that are in question, but the processing capacity," London said. "This is the missing link. Value-adding manufacturing."

That message is getting noticed. Ontario's re-elected Progressive Conservatives have pledged to set up a $500-million critical mineral processing fund to invest in "strategically located" facilities to develop lithium, graphite, zinc, cobalt and other key minerals and metals in the province.

London said Ottawa should convene a CEO panel from the biggest minerals and metals producers to agree on five critical minerals projects that they would invest in. These hubs would include mining operations, processing and other manufacturing facilities.

"The strategy should be demand-based when considering where to deploy the development capital. What industries are you trying to support?” he said, noting that industries from autos to AI need critical minerals.

“We can't wait 18 to 20 years to get this going. We are already far behind China, Australia and others.”

(Additional reporting by Darius Snieckus)

(Sources: Natural Resources Canada, Center for Strategic and International Studies, Canadian Critical Minerals & Metals Alliance)