Troy Shantz and George Mathewson

Sarnia is in the crosshairs of Ontario’s new ‘Cap and Trade’ system and that’s casting a cloud of uncertainty over the entire local economy, officials of all stripes say.

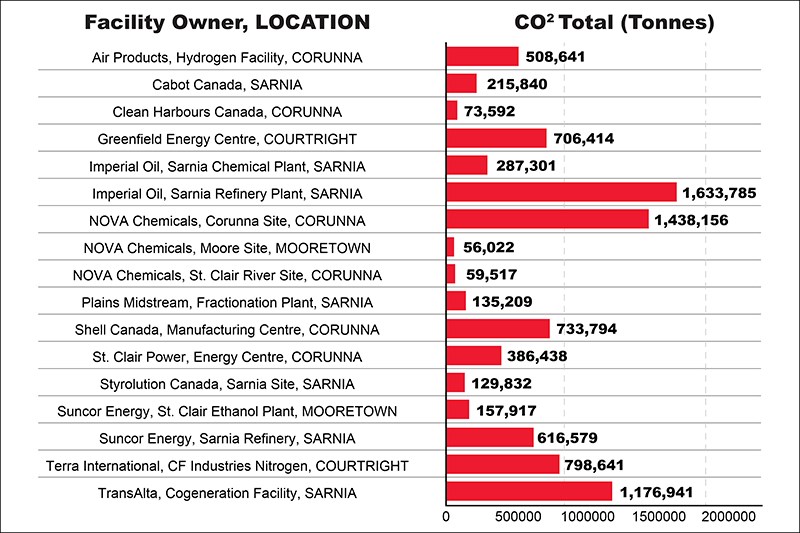

Some 24% of Ontario’s industrial greenhouse gas (GHG) emissions are generated locally, led by some of the largest employers in Sarnia including Imperial Oil, Nova Chemicals and TransAlta.

Facilities that generate more than 25,000 tonnes of GHG per year — there are at least 17 locally — are required to participate in cap and trade.

“We are extremely concerned about the impact this uncertainty and added cost will have on jobs and the economy,” said Shirley DaSilva, president of the Sarnia-Lambton Chamber of Commerce.

“We are concerned that policy-makers don’t know the full impact cap and trade will have.”

Large industrial facilities, which are the engine that drive the local economy, will eventually be forced to buy offsetting carbon credits. The fear locally is that the corporate owners of these facilities, saddled with additional costs, could scale back operations or simply move to jurisdictions with lower or no carbon prices.

The first auction of greenhouse gas allowances is scheduled for March 22, and the government intends to link with Quebec and California cap-and-trade markets in 2018.

During the first compliance period, most large emitters will receive most of the allowances they require free-of-charge, the government says.

But the number of allowances allocated each year will decrease, requiring companies to buy additional allowances at auction or sale.

Peter Smith is a former operations director at TransAlta and a Green Party candidate in the last federal election.

He believes cap and trade is needed to address climate change, but he also worries it is making Ontario industries less competitive.

“If you’re making widgets here and you’ve got this extra cost, and somebody’s doing it in the States and they’re not, then you’ve just given them an advantage,” he said.

“So you’ve got to be able to equalize this, to create a flat playing field for everyone.”

Nevertheless, Canada has just 0.50 percent of the world´s population but produces 2% of the world’s GHG emissions.

“People always say, ‘We’re only two percent so what does it matter?’ But if everybody says that then nobody does anything.”

The Ontario chemical industry – much of it based in Sarnia - was the third largest manufacturing sector in province in 2014 with output of $24 billion.

But the mere threat of cap and trade has prompted most new investment to move to the U.S. Gulf states, said Luc Robitaille, a vice president of the Chemistry Industry Association of Canada.

Could companies simply pull up stakes here and move?

“My feeling is that it’s possible, yes. Already we’re seeing that we can’t attract the new investment,” he said.

Robitaille said the full impact of cap and trade probably won’t be felt until the first compliance period ends in 2020. But the initial signs aren’t encouraging.

“Every plant that goes to Texas is an investment lost over 20 or 30 years,” he said.

“Cap and tradehas the potential to hurt, but it also has the potential to help if the government is willing to invest in the right areas.”

Big greenhouse gas emitters